Introduction

Looking for the next multibagger opportunity in the Indian stock market? In this article, we reveal a powerful strategy to find high-potential stocks under ₹100 using a smart screener formula backed by fundamentals and institutional interest. These filters will help you target small-cap gems poised for long-term wealth creation.

Why Focus on Stocks Under ₹100?

Stocks priced under ₹100 are generally from the small- or mid-cap segment and can offer explosive growth if backed by strong fundamentals. However, not all low-priced stocks are worth your money. That’s why we’ve combined a data-backed approach to eliminate weak stocks and highlight only the worthy

Smart Screener Formula Criteria

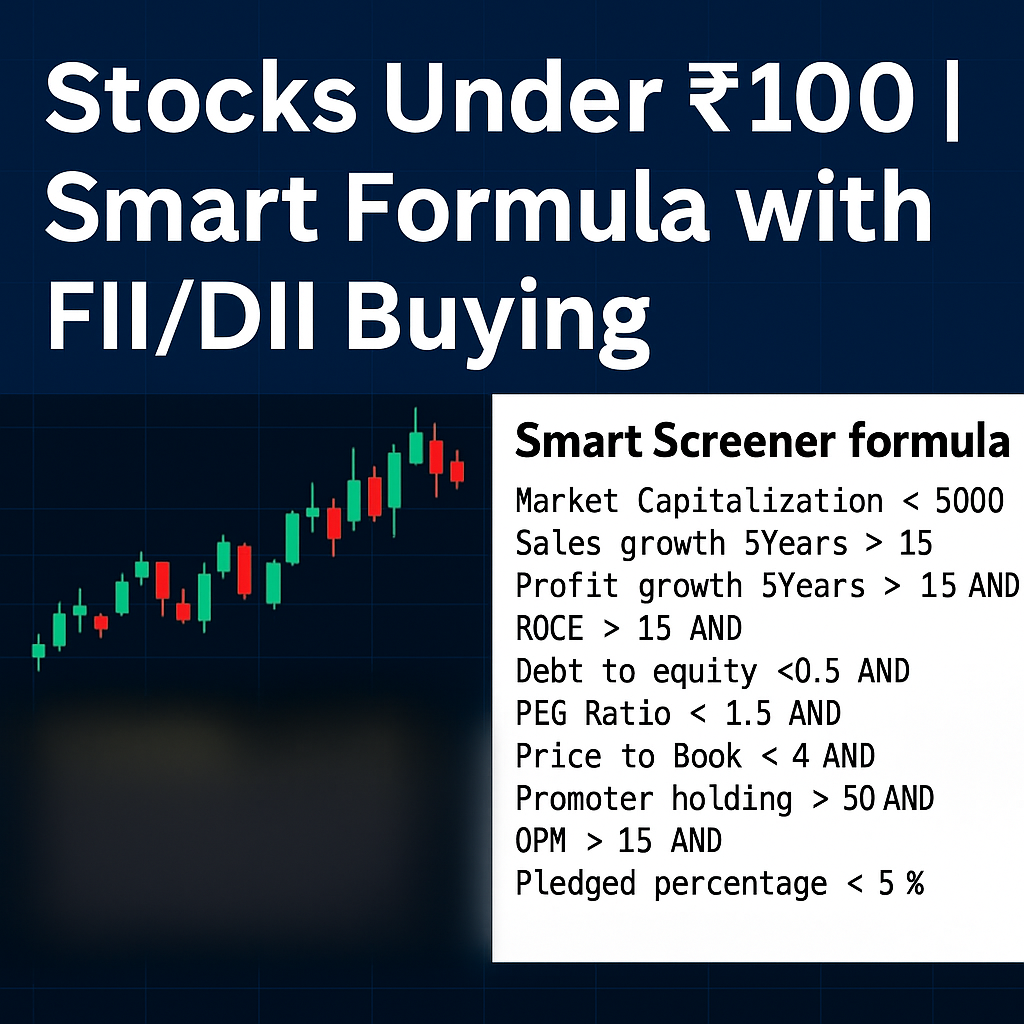

Here’s the exact formula used to screen the best multibagger picks:

Current price > 50 AND

Current price < 100 ANDMarket Capitalization < 5000 AND

Sales growth 5Years > 15 AND

Profit growth 5Years > 15 AND

Sales growth > 10 AND

Net profit growth > 10 AND

ROCE > 15 AND

ROE > 12 AND

Debt to equity < 0.5 AND

PEG Ratio < 1.5 AND

Price to Book < 4 AND

Promoter holding > 50 AND

OPM > 15 AND

Pledged percentage < 5 AND

FII holding > FII holding 1 quarter ago OR DII holding > DII holding 1 quarter ago

Explanation of Each Filter

Filter PurposePrice ₹50–₹100 Targets affordable but solid stocks

Sales & Profit Growth > 15% Indicates business scalability

ROCE > 15% / ROE > 12% Reflects capital efficiency

Low Debt (D/E < 0.5) Financial stability

PEG Ratio < 1.5 Valuation vs growth balanced

Promoter Holding > 50% Management confidence

Low Pledged Shares Lower risk of distress

Sector Focus

Targeting future growth themes (Infra, Renewable, Defense)

FII/DII Interest Institutional validation of quality

Why FII/DII Buying Matters?

Institutional investors conduct deep research before investing. An increase in FII or DII holding in a stock is often an early signal that the company has solid potential and may outperform.

Top Sectors to Watch

Renewable Energy – India’s energy transition is a multidecade themeI

nfrastructure – Supported by government spending

Defense – Indigenization and exports boosting growth

Disclaimer

This article is for educational purposes only. Stock market investments are subject to risks. Always do your own research or consult a SEBI-registered advisor before investing.